Managed Futures: DBi’s Guide For Advisors

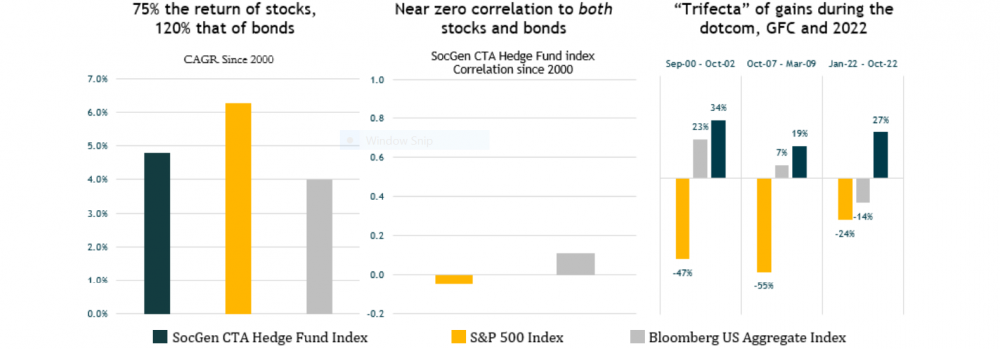

This is a short form guide to investing in managed futures for you: financial advisors in the wealth management space. In sum, we think managed futures is the single most valuable diversifier you can add to a portfolio of stocks and bonds and has the potential to add more bang for the buck than private equity, REITS, commodities and many other widely-sed alternatives. Since 2000, the strategy – as measured by the SocGen CTA Hedge Fund index[1], in our view the best source of long-term data on the space – has delivered:

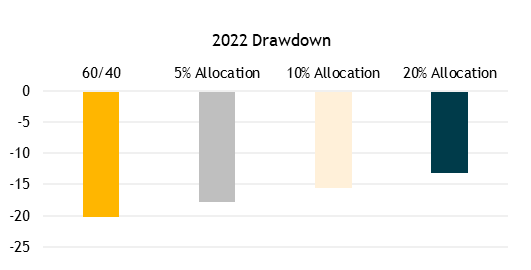

With stocks and bonds moving in tandem for the first time in decades, the diversification benefit is even more acute: a 10% allocation in 2022 would have cut losses in a 60/40 portfolio by a fifth[i]. We believe that an allocation to managed futures in the 5-20% range should be considered over the next decade.

The trick is getting the allocation right. Those who discovered the space in the 1990s might remember egregious fees and extreme volatility. Many of you who were early adopters of managed futures mutual funds in the 2010s had bad experiences. The good news is that times have changed: managed futures mutual funds and ETFs today are far better than a decade ago. The bad news is that there still are a few major “landmines” that can trip you up. This guide can be a starting point to help you understand how managed futures can fit into an investment portfolio.

- It’s Not as Complicated as it Sounds

Here’s what you need to know about “managed futures”: it’s an investment strategy that hunts for trends in dozens or hundreds of assets for which there are futures contracts – think crude oil, Treasuries, S&P 500, Japanese yen. In other words, if crude oil is rising (falling), they might go long (short) the futures contract and bet it continues. Firms use quant models to study past prices to decide what to buy and sell, and diversify across commodities, rates, equities and currencies. As markets (and prices) shift, they tactically move around – hence, managed unlike, say, buying and holding gold. Why futures? Because it’s an extremely liquid, efficient way to bet on these price moves.

We think of it this way: managed futures funds ride market waves. The best time is when market earthquakes cause a few tsunamis, like 2022; sometimes it’s choppy and they bounce around but don’t make much forward progress. The good news is that there are always waves, and managed futures funds potentially are a way to make money off them.

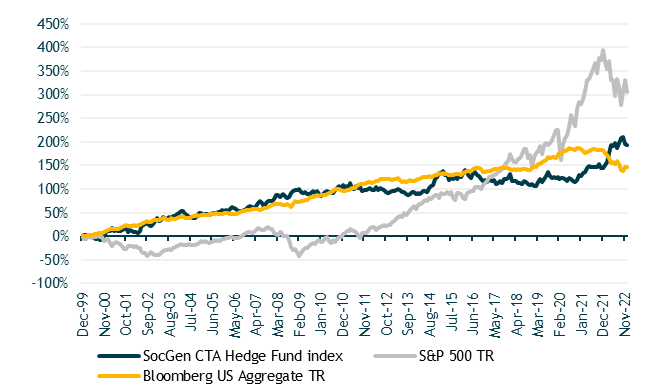

2. The Long-term Returns Tell a Compelling Story

The return statistics mentioned above –“75% of the return of equities, 120% of the return of bonds” – shock a lot of people. Many learned of the strategy during the recent “long winter” of 2015-20, when a combination of the Fed put and near zero interest rates meant low returns, especially relative to soaring stocks and bonds. The chart on the right provides more historical context. Since 2000, the SocGen CTA[2] has offset equity risk during all the three prolonged bear markets and managed to keep up with fixed income during most of the great bond bull market – only to flip to an inflation play and make money from the recent rise in yields. From a more technical perspective, low correlation to the rest of your portfolio means more “alpha”: 300-400 bps per annum to each of stocks and bonds –unusual for a diversifier.

3. There’s a Simple and Clear Reason Why We Believe It Should Work

Like the illiquidity premium, value factor, etc., trend-following has the ability to generate alpha because most investors are not set up to make money this way. In general, we’re trained to think markets revert and buy the dip. Like Buffett’s trope about cutting flowers and watering weeds, we often sell winners too soon and hold losing positions too long. Model portfolios based on ten- or twenty-year assumptions will not turn on a dime. Wall Street strategists that touted “low rates forever” won’t retract that advice based on a few datapoints. “Biases” and these kinds of “constraints” mean many investors leave money on the table. Managed futures funds try to sweep it up: in 2022 most managed futures funds detected the signs of inflation early, repositioned portfolios quickly and rode it. That kind of alpha generation, we believe, is not going away any time soon. You can think of managed futures as outsourcing a portion of your portfolio to a tactical strategy that might find trades – in 2022, shorting Treasuries and the yen – that most of us likely won’t or cannot do on our own.

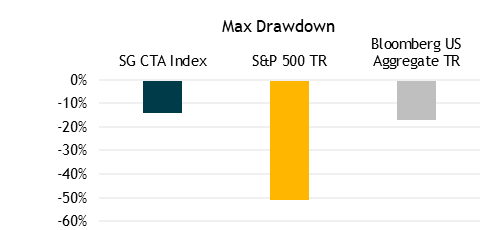

4. It Has Been Less Risky than You Fear

A “quantitative, long and short, leveraged derivatives-based strategy” conjures images of blow ups. And yet, the SocGen CTA Hedge Fund index[3] has had a volatility of around 9% since 2000, about halfway between stocks and bonds. More tellingly, over the same time period, the maximum drawdown is -14% – less than a third of equities and now, even less than bonds. Why? Managers diversify across markets and size positions prudently – after all, they don’t want to blow up either. Lastly, futures contracts are incredibly liquid so funds can get out of positions when they need to. Short answer: many of fears about managed futures are overblown.

5. Unfortunately, You Probably Cannot Time It

Or, if you can, you know something we don’t. We jumped into the space in 2015 to hedge a portfolio for a crisis that hit in … 2022. Some of the smartest allocators to hedge funds bailed just before the rebound. We believe it is prudent to pick the correct allocation size and stick with it.

6. What Do We Believe is a Prudent Allocation?

Here’s the math: add 5% to a 60/40 portfolio, and historical drawdowns improve by over 10%; add 20%, the benefit triples. Here is a chart from our partner, iMGP, on the impact during 2022.[ii] The answer will depend a lot on all the idiosyncratic features of your business and portfolios: holdings today, your competitive positioning, client makeup, etc.

7. Investing is a Lot Trickier than It Seems

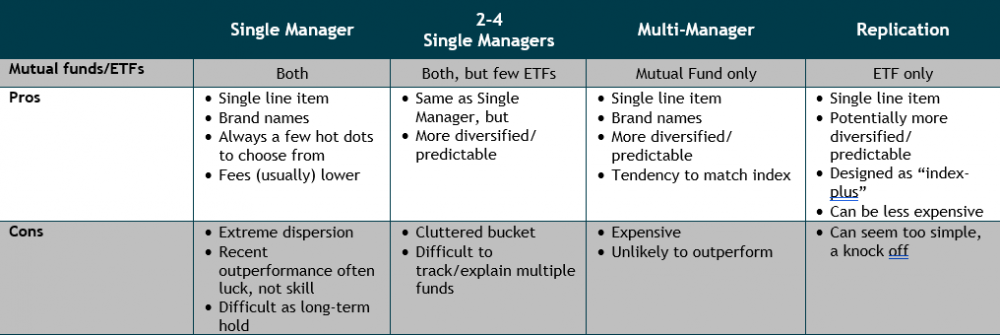

Now the big issues. If the SocGen CTA Hedge Fund index came in a mutual fund or ETF, investing in the space would be easy. That index, though, just represents the average performance of twenty leading managed futures hedge funds and you can’t invest in it. An institution might invest directly in half a dozen constituents of the index to approximate it. Your job is more difficult. Given accreditation and other issues with hedge funds, many will invest only in mutual funds or ETFs, where there are more good options than a decade ago, but still slim pickings relative to the hedge fund world. As a practical matter, let’s discuss four strategies:

To build a durable long-term strategy to invest in the space, we believe that the primary goal of fund selection should be to reliably match or outperform the index or benchmark. During the 2010s, many early adopters chose the “single manager” path and selected funds they believed would accomplish this. For reasons described in the next section, we think this approach is too risky and explains, in part, why many advisors grew frustrated with and abandoned the space.

8. Single Manager Risk Can Be a Huge Landmine

Single manager risk means you may pick a fund that underperforms everybody else (the benchmark) … by a lot. Why care? Because it’s hard to explain to clients why “the best guy in the space” is suddenly the worst. How much of a risk is this? Last year, the strategy (SocGen CTA Hedge Fund index[4]) was up 20% but around a fifth of mutual funds and ETFs actually lost money.[iii] During the 2010s, the most popular single manager fund (by far) underperformed the index by 20% over five years. Some of you have told us that dealing with a single manager “problem child” can mean a 5% allocation consumes 30% of your time – explaining it to clients, deciding if/when to redeem, etc.

This landmine is particularly tricky because most mutual funds today look great relative to the index. Unfortunately, that’s largely a function of the fact that the industry regularly shoots the wounded: 40% of mutual funds and ETFs from five or six years ago are gone today. (The dead funds, obviously, mostly underperformed.) The cold statistical reality is that recent stars are no more likely to outperform, and just as likely to end up near the bottom of the pack. Plus, given how this industry works, you’ll get barraged with calls about a top performer, not the fund that lost money last year, and the pitch will be “we built a better mousetrap” rather than “we got lucky.” Caveat emptor.

Many of you battle-hardened veterans figured this out and today pick 2-4 single managers. It takes more time to monitor, but we hear it’s worth it to reduce “problem child” risk. For those who want a single line item to fill the strategy bucket – in essence, outsource single manager diversification – we encourage you to consider one of the few available multi-manager mutual funds or replication. The multi-manager pitch is that they can provide valuable diversification and select managers who, on average, will outperform the index enough to offset higher fees. The replication approach is to mimic the core positions of all the funds in the index and potentially outperform through fee and expense savings.

From an asset allocation perspective, we want to underscore this: the strategy (SocGen CTA Hedge Fund index) has potent long-term diversification benefits, single manager funds generally will not due to idiosyncratic risk. That distinction is critical when formulating a strategy to invest in the space.

9. Fees and Expenses Can Increase the Risk of Dead Money

Few care about fees in banner years. And fees often seem secondary when evaluating a fund on a hot streak. But as a long-term allocator, they can matter a great deal. In particular, it’s the tough years when people start asking questions. Look at it this way: in choppy seas, the strategy (SocGen CTA Hedge Fund index) might deliver 3-5% per annum over cash – but no better than cash after fees and expenses. That was a huge problem during the “long winter” in the late 2010s, when cash was earning roughly zero and, hence, clients made zero. Mutual funds generally have higher management fees than the hedge funds in the index, but no performance fees; ETFs tend to be less expensive.

There’s no perfect answer here. Some of the better performing mutual funds last year had high fees, as did some of the worst. Lower fees in some products were cold comfort after years of persistent underperformance. We think the fee question plays out in a few ways. First, lower fees can matter a great deal when you – the allocator – are judged in part on the all-in cost of investing, whether on client statements or to land new business. Second, clients may be more patient during those inevitable lower return periods – it’s just grates on people when it looks like everyone is making money but them. Lastly, all things being equal, client capital grows more over time: by analogy, at the institutional level, the largest allocators rarely pay “headline” fees and hence typically outperform the index – which gave rise to our expression, “in hedge funds, fee reduction is the purest form of alpha.”

10. Clients Management Requires Its Own Strategy

By now, many of you will be convinced about the benefits of the strategy but wondering how to manage clients. First, rather than try to describe how the sausage is made, we think you should pick metaphors that resonate: “flood insurance where, with this policy, you get paid while you wait” or “these are smart investors who use computer models to try to ride the market waves.” Perhaps it’s better to frame the allocation as a “hedge against another decade like the 2000s” or “years of higher inflation.” Second, we think the allocation should be framed as a “strategic, long-term diversifier” – not a trade. Just like stocks and bonds, clients should expect to see the allocation in their statements in ten years. Along this line, we caution against overselling hot dots, which can lead to unrealistic performance expectations as well as a short-term mindset. Third, we encourage setting expectations about both good periods, like 2022, as well as lower return periods. We think the most effective way to do this is to anchor ongoing results to the strategy, and implicitly reference the long history of results through different market regimes. Finally, we think fees should be part of the discussion, since more “equitable” fees structures can foster patience over a market cycle.

* * *

We hope you found this short form white paper useful. We believe that education – both theory and practice – will be critical to bring more of you into the managed futures tent. For some, education is about learning the basics of the strategy and its potential benefits; for others, it’s about correcting common misunderstandings. In either case, we hope this paper is a step in the right direction. As always, we welcome any and all feedback!

Note: For discretionary use by investment professionals. This document is provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Past performance may not be indicative of future results and there can be no assurance the views and opinions expressed herein will come to pass. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

The [investor] acknowledges that AdvisorIntelligence is beneficially owned by iM Square SAS, a Paris based investment and development platform (“iM Square”). AdvisorIntelligence, from time to time, expects to include in its investment models certain investment funds (collectively, “iM Square Funds”) sponsored or managed by investment advisers in which iM Square has a beneficial ownership interest (“IMGPUS Affiliates”). This arrangement creates a material conflict of interest because AdvisorIntelligence has an incentive to include iM Square Funds in its investment models. IMGPUS Affiliates do not waive fees for these investments. Therefore, assets invested in iM Square Funds will be charged two layers of fees, one by AdvisorIntelligence and another by the iM Square Funds.

Our due diligence process for managers and funds is grounded in our conviction, supported by extensive research, that skilled managers can and do deliver superior performance over the long term. An essential part of the value we provide is the multiple decades of experience we bring to bear in assessing and selecting exceptionally skilled managers. We engage in exhaustive quantitative and qualitative research aimed at uncovering those select managers with an identifiable and sustainable investing edge. Here are just a few critical elements we look for in our due diligence:

- A clearly defined and well-articulated investment process supported by evidence of successful implementation over time

- A manager or team that demonstrates a high level of integrity, intellectual honesty, and a passion for investing

- Supportive team dynamics and a culture that insulates key investment personnel from noninvestment-related responsibilities

- Outperformance versus relevant benchmarks and peers that is consistent with our expectations given certain market environments

- Consistent outperformance (i.e., over rolling periods) versus benchmarks and peers that is a result of a time-tested investment process

This rigorous process yields a select list of managers. For those we decide to invest with, our analysis is not a once-and-done exercise. We continue to closely monitor fund performance and investment decisions through regular updates with our managers, aimed at making sure they remain committed to their investment process and disciplined in its execution and is the basis for the opinions shown below.

Recommended = These are funds we are confident will outperform an index fund alternative over a market cycle.

Approved+ = Approved funds we are actively researching and consider to be realistic candidates for upgrading to Recommended.

Approved = Funds we believe will perform at least as well as, if not in excess of, an index fund alternative over a market cycle.

Noteworthy = Funds we view as promising. The record may be too short or we may need to do additional due diligence before making a final decision on the status (Approved, Recommended) of the fund.

Under Review = We are currently conducting follow-up due diligence to address questions that have arisen since our last review. While these questions are material enough to warrant further investigation, we do not feel they are material enough to warrant an immediate downgrade.

Recommendation - Index Funds & ETFs

Core = Funds/ETFs that are our preferred vehicle for gaining index exposure to an asset class. These vehicles are recommended for those who would rather use an index fund in lieu of funds in the model portfolios.

Tactical = ETFs and index funds we are currently using or have used in the past for tactical purposes in place of Core funds.

Alternative = Funds we believe are acceptable alternatives to Core funds, though they are not our preferred choice due to any number of factors, including expenses, asset base, index construction and methodology, and the experience of the fund sponsor.

[1] The index is not representative of the entire population of CTAs or hedge funds. The index's performance may not be indicative of any individual CTAs or hedge funds. The index may not have been adjusted for fees/commissions. The index cannot be traded by individual investors. The actual rates of return experienced by investors may be significantly different and more volatile than those of the index.

[2] The index is not representative of the entire population of CTAs or hedge funds. The index's performance may not be indicative of any individual CTAs or hedge funds. The index may not have been adjusted for fees/commissions. The index cannot be traded by individual investors. The actual rates of return experienced by investors may be significantly different and more volatile than those of the index.

[3] The index is not representative of the entire population of CTAs or hedge funds. The index's performance may not be indicative of any individual CTAs or hedge funds. The index may not have been adjusted for fees/commissions. The index cannot be traded by individual investors. The actual rates of return experienced by investors may be significantly different and more volatile than those of the index.

[4] The index is not representative of the entire population of CTAs or hedge funds. The index's performance may not be indicative of any individual CTAs or hedge funds. The index may not have been adjusted for fees/commissions. The index cannot be traded by individual investors. The actual rates of return experienced by investors may be significantly different and more volatile than those of the index.

[iii] 2022 performance of constituents of the Morningstar US Systematic Trend index. Bloomberg data.