RBA

Overview

About

RBA strives to be the leading provider of innovative investment solutions for investors, and their competitive edge is a research driven macro style of investing.

RBA is an investment manager focusing on longer-term investment strategies that combine top-down, macroeconomic analysis and quantitatively-driven portfolio construction.

RBA was founded by Richard Bernstein in 2009 and is headquartered in New York City.

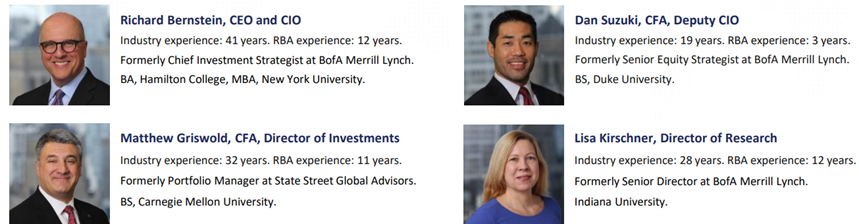

Their top-down macro, research-driven approach differentiates their firm from the more common, traditional bottom-up approach of most asset managers. That research starts with Richard Bernstein, our CEO, who is widely recognized as an expert in style investing and asset allocation. He has over 40 years' experience on Wall Street, including most recently as the Chief Investment Strategist at Merrill Lynch & Co.

They provide their clients with tailored asset allocation solutions that are embedded with our intellectual capital. Their products are available at most major financial wirehouses, select RIA platforms & TAMPS and for institutional investors.

Investment Approach

They generate alpha by uncovering global investment styles and themes where they believe there are disparities between fundamentals and sentiment. This is very different from the traditional, bottom-up approach that seeks to generate alpha through individual security selection.

The RBA investment process focuses on fundamentals – with particular emphasis on corporate profit cycles rather than economic cycles. The investment process centers around hundreds of indicators which fall into three key categories: corporate profits, liquidity and investor sentiment/valuation.

The origins of their investment philosophy date back to the seminal research they conducted on style investing more than twenty years ago. The expertise lies in their disciplined process of combining their proprietary, macroeconomic research with quantitative analysis to determine cyclical and secular investment themes, aiming to provide superior, risk-adjusted returns.

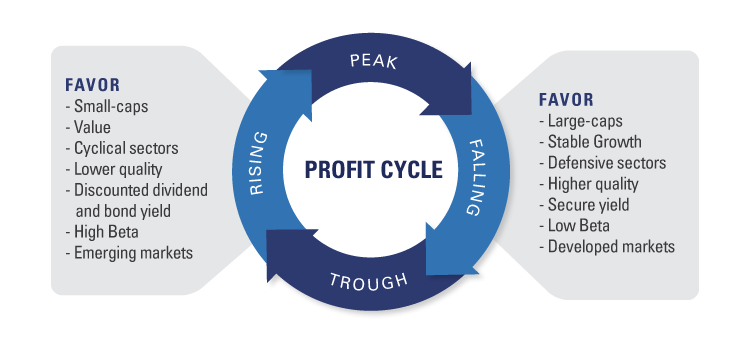

Analysis of global profit cycles is a core component of their strategies. They identify inflection points in global business cycles and then allocate appropriately across asset classes, sizes, styles, industries, geographies and themes. Examples of market segments they may favor at various points in the cycle are illustrated below.

The Investment Team

Funds

Our Strategies

Richard Bernstein Advisors offers a suite of global "go-anywhere," tactical portfolios for a variety of risk tolerances. These portfolios exclusively utilize ETFs to be low cost, transparent, scalable and liquid.

All of their strategies are centered around our top-down, macroeconomic research which focuses on fundamentals: corporate profits, liquidity and investor sentiment.

Global Aggressive |

Fact Sheet | Presentation |

Global Conservative |

Fact Sheet | Presentation |

Core Plus |

Fact Sheet | Presentation |

Global Equity |

Fact Sheet | Presentation |

Global Moderate |

Fact Sheet | Presentation |

Global Risk-Balanced Moderate | Fact Sheet | Presentation |

Portfolio manager

Commentary/Insights

|

3Q25 Aggressive |

Commentary |

|

3Q25 Conservative |

Commentary |

3Q25 Core Plus | Commentary |

3Q25 Equity |

Commentary |

3Q25 Moderate |

Commentary |

3Q25 Risk Balanced | Commentary |

Archive

2Q2025

Global Aggressive |

Fact Sheet | Presentation | Commentary |

Global Conservative |

Fact Sheet | Presentation | Commentary |

Core Plus |

Fact Sheet | Presentation | Commentary |

Global Equity |

Fact Sheet | Presentation | Commentary |

Global Moderate |

Fact Sheet | Presentation | Commentary |

Global Risk-Balanced Moderate | Fact Sheet | Presentation | Commentary |