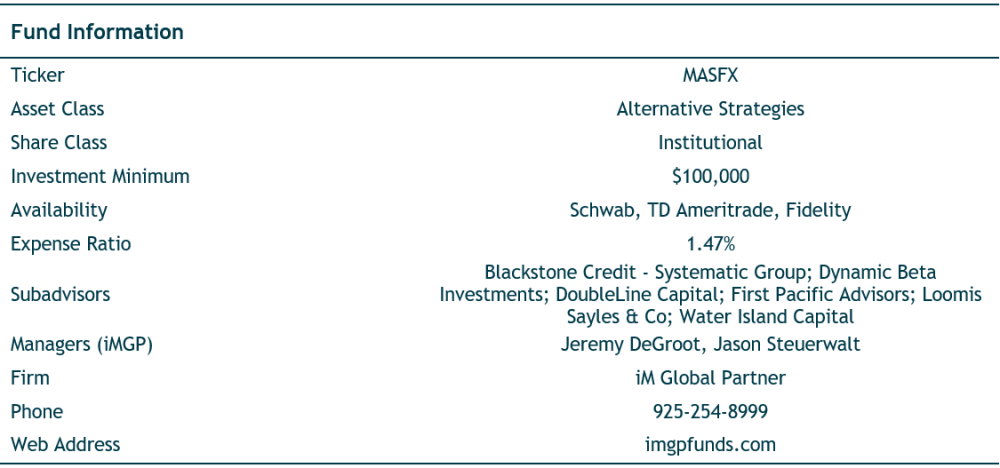

iMGP Alternative Strategies Due Diligence Report

Fund Overview:

The iMGP Alternative Strategies fund is a multi-manager, multi-strategy fund that combines alternative and absolute-return-oriented strategies based on IMGP’s conviction that each individual strategy is compelling on a standalone basis, and when combined, we believe they create a well-diversified alternatives portfolio in terms of strategy and instrument type.

In creating this fund, we sought to build a core, all weather, risk-aware alternatives solution that we believed could perform better than equities during bear markets, have lower volatility, lower beta and relatively low correlation to stocks and (particularly) bonds, while still being able to deliver solid long-term performance. We believed the key to achieving these goals was finding skilled managers who were extremely risk-conscious and/or ran strategies that were inherently lower risk. However, we also wanted managers and strategies that were able and eager to take advantage of compelling opportunities to potentially generate returns when they became available.

That last point was a very important one when creating the fund. We didn’t want managers that focused exclusively on avoiding losses; rather, we wanted managers who were willing to be opportunistic and move to a more aggressive positioning when appropriate to potentially produce attractive returns when they were offered by the markets. We thought allocating to experienced, battle-tested managers with a history of managing through cycles was an important component in trying to achieve this part of the fund’s profile.

In terms of the risk and return targets, the fund is trying to achieve strong absolute and relative risk-adjusted returns over a full market cycle. Our intentionally broad return goal is 400 to 800 basis points over 3-month Treasury bills. Importantly, our intention is for the fund to deliver those returns with low volatility, in the 4% to 8% range, and ideally with low correlation to stock and bond markets. The recent addition of DBi’s Enhanced Trend strategy is another step in that direction, as it is intended to increase the fund’s diversification potential. The Alternative Strategies Fund is intended to be used by investors as a source of diversification for traditional stock and bond portfolios to reduce volatility and potentially enhance risk-adjusted returns compared to a conservative stock/bond mix (its presumed funding source).

Portfolio Strategy and Construction:

At the strategy level, several things distinguish the Alternative Strategies Fund. Our objective was to find managers and strategies that were inherently low risk, either by virtue of the manager’s own investment philosophy, the nature of the strategy they run, or both. At the same time, we wanted managers/strategies that would be opportunistic in environments where they were highly confident and have produced strong excess return relative to the additional risk assumed. We believe the flexibility to vary the level of risk exposure based on the opportunity set is enhanced by the multi-manager construct, since the drivers of performance and risk differ across strategies.

We selected managers with transparent strategies that we could analyze with confidence, and ones with live rather than back-tested track records. It was more important to us to have high quality, high conviction managers that we felt have delivered an attractive risk/return profile than it was to check every box on the “alternative strategy” list for marketing purposes. It was also important that each manager could adapt their strategy to take advantage of the multi-manager structure. Examples include using (modest) leverage, having greater flexibility in portfolio construction by asset class, the ability to increase concentration in higher-conviction positions, etc. However, we don’t intend for managers to add risk just because they can, but rather to utilize this flexibility when their conviction is high. We believe the low average correlation among managers/strategies and low overall volatility allow for greater opportunism at the individual manager level, and thus improve the fund’s potential to generate attractive returns.

Each sub-advisor has an investment approach that generally focuses on a particular asset class or specific strategies, although we tend to favor giving managers more flexibility within their respective strategy domains rather than having a plethora of very tightly constrained managers. Currently, the strategies the sub-advisors focus on are as follows: (1) an arbitrage oriented strategy; (2) an opportunistic income strategy which typically focuses largely on mortgage backed securities (MBS) but has the ability to invest broadly across fixed income markets; (3) a contrarian opportunity strategy that invests across asset classes (though typically with a significant equity allocation), market capitalizations, industries and geographies, and includes a limited exposure to less liquid positions; (4) an absolute-return fixed-income strategy that tactically allocates across a wide swath of global fixed income sectors with the ability to take complementary rates and currency positions; (5) a quantitative-driven long/short credit strategy; and (6) a replication-based combination of trend following (75% weight) and equity hedge (25% weight) strategies.

Strategic target allocations to the different sub-advisors are set based on a number of factors, including iM Global Partner’s expectation for the risk-adjusted return potential of each sub-advisor’s strategy and the impact on overall portfolio risk. The overall objective is maximizing returns subject to the goals of low volatility, capital preservation relative to equities during market drawdowns, and relatively low correlation to broad financial markets. While historical returns and risk metrics are analyzed and considered, along with views on the current and prospective opportunity sets, the strategic allocations are not overly “optimized.” This decision reflects an effort to create a portfolio that is robust and can perform reasonably well across a range of economic and market environments.

We may at times adjust the allocations of capital to sub-advisors if the team believes there is a highly compelling tactical opportunity in a particular sub-advisor’s strategy. However, such tactical overweights or underweights are rare, having occurred once thus far in the fund’s history. We maintain a healthy respect for the unknown and unknowable, as well as a belief that consistently adding value through frequent tweaks is challenging at best. Thus, we maintain a very high bar to tactically move away from the strategic allocation. Changes to the strategic weights typically occur when a manager is added or removed. Since the fund’s inception (9/30/2011), three sub-advisors have been added and one has been removed. It is possible that additional managers and strategies will be added to the Alternative Strategies Fund in the future, although the fund is very likely to maintain a concentrated group of sub-advisors.

We may hire sub-advisors that focus on other strategies in the future, and not all strategies that may be appropriate will be represented in the fund’s portfolio at all times. The only strategies we explicitly avoid are “black box” strategies (e.g. ones where we have very little or no information on how the investment decisions are made).

Jeremy DeGroot and Jason Steuerwalt are the co-Portfolio Managers of the Alternative Strategies Fund. Jeremy is the firm’s CIO for US Asset Management and leads the research team that supports the fund. Jason is a Director in US Asset Management and Head of Alternative Strategies. Three other members of the US Asset Management research team support the fund, and the team regularly meets and discusses the fund with Philippe Uzan, iMGP’s Global Asset Management CIO.

DeGroot and Steuerwalt make all decisions on adding and removing managers and on allocations among managers, with input from the iMGP Asset Management team. When considering new strategies, a lead analyst is responsible for leading an in-depth due diligence effort and along with a secondary analyst presents the idea to the team. The recommendation is vetted in one or more team meetings, often leading to follow up work to address remaining questions or concerns. Ultimately, the full team typically reaches a consensus on hiring a new manager. Additionally, the Chief Operating Officer and the Chief Compliance Officer conduct reviews relevant to their areas of expertise, and the Board of Trustees must approve the addition of new managers. Decisions on relative weightings among managers can be made at the discretion of the co-portfolio managers, with input from the Asset Management team.

Strategies and Subadvisors:

Opportunistic Income Strategy

Jeffrey Gundlach

Jeffrey Sherman

DoubleLine Capital

The Opportunistic Income Strategy is a best-ideas portfolio across the fixed income universe, with a focus on mortgage-backed securities (MBS), DoubleLine’s greatest area of expertise. Gundlach and the DoubleLine team seek to deliver positive absolute returns in excess of the Bloomberg Aggregate Bond Index (the AGG) with volatility similar to long-term U.S. Treasuries. Investment ideas employed by DoubleLine must offer an asymmetric, positively skewed risk-reward profile. As a result, a great deal of their analysis seeks to identify fixed income securities that they believe offer greater potential payoff than potential loss under multiple scenarios. Ultimately, a combination of risk management, asset allocation and security selection forms DoubleLines’s investment process.

Portfolios are constructed with the intent to outperform under a range of future outcomes. DoubleLine’s risk integration process seeks to combine assets that will perform differently in different scenarios so that the overall portfolio generates acceptable performance. This has historically resulted in a portfolio “barbelled” by credit-sensitive assets on one end and high-credit quality, longer-duration assets on the other. This process includes balancing the strength of cash flows from certain asset classes against various potential economic or market risks.

In implementing the Opportunistic Income Strategy, DoubleLine can invest in, without limitation, asset-backed securities (ABS); domestic and foreign corporate bonds, including high-yield bonds; bank loans and collateralized loan obligations (CLOs); municipal bonds; domestic or foreign governments bonds, including emerging markets countries; real estate investment trust (“REIT”) debt securities; and mortgage related securities.

When investing in mortgage related securities, DoubleLine may invest in obligations issued or guaranteed by agencies or instrumentalities of the U.S. Government (“Agency MBS”); collateralized mortgage obligations (“CMOs”) including real estate mortgage investment conduits (REMICS) issued by private issuers (“non-Agency MBS”); commercial mortgage backed securities (“CMBS”); “interest only” and “principal only” stripped mortgage securities; inverse floating rate securities; and debt or equity tranches of collateralized debt obligations collateralized by MBS. DoubleLine may, to a limited extent, employ leverage within the Opportunistic Income Strategy.

Contrarian Opportunity Strategy

Steven Romick, CFA

Brian Selmo, CFA

Mark Landecker, CFA

First Pacific Advisors

The Contrarian Opportunity Strategy seeks strong risk-adjusted returns by investing flexibly across equities and other asset classes. As absolute return investors, the FPA team seeks absolute bargains rather than relatively attractive securities. The goal is to provide equity-like returns over longer periods (i.e., five to seven years) while protecting against the permanent loss of capital.

The FPA team employs the broad mandate of the FPA contrarian strategy to invest across the capital structure, asset classes, market capitalization, industries and geographies using a wide variety of instruments. The FPA team invests in an opportunistic manner, based on its view of the world and the businesses/situations that it understands. It looks for what is out of favor, taking into account the current landscape and how it might change over time, both organically and through exogenous events.

The FPA team invests across five broad categories: Long Equity, Short Equity, Credit, Cash and Equivalents and a smaller “Other” category.

Long Equity: The FPA team may invest in companies with solid balance sheets and unquestionable competitive strength and shareholder-centric management; companies of lesser quality but with strong long-term upside potential; companies with shorter term upside potential driven by identified catalysts that are expected to have a positive impact on the value of the underlying business such as balance sheet optimization, operational turnarounds or corporate actions; and companies whose disparate parts have greater aggregate value than the current stock price (“sum-of-the-parts”). In such situations, it may engage in intra-company arbitrage by either holding long positions in one share class of such a company and shorting another share class of the same company or buying a parent or holding company and shorting one or several of its underlying companies to create a stub equity position that is valued at a deep discount.

Short Equity: The FPA team will occasionally seek directional opportunities in deteriorating companies with declining business metrics that are not reflected in the stock price and/or companies with balance sheet issues. More commonly, short positions are parts of paired trades that involve shorting a company in the same industry as one of the long positions the FPA team holds, to serve as a partial hedge against industry specific risk, or intracompany arbitrage as discussed above.

Credit: The FPA team will consider performing credits that have a yield to maturity reasonably in excess of U.S. Treasuries of comparable maturity. The FPA team may also purchase distressed debt, which it defines as corporate debt that has either defaulted or which has a high likelihood of being restructured, either voluntarily or by default.

Other: Investments will typically include illiquid securities that the FPA team believes allow it to take advantage of situations that are not available in the public markets. These could include private equity, private debt, and real estate investments. Illiquid assets are limited to no more than 15% of the FPA team’s portfolio, but have historically been below 5%.

Cash and Equivalents: The level of cash and cash equivalents is a residual of the FPA team’s investment process rather than a macro-driven decision. The team believes that liquidity is an important risk management tool and that it provides valuable optionality to potentially take advantage of market dislocations.

Absolute Return Fixed Income Strategy

Matthew Eagan

Todd Vandam

Brian Kennedy

Elaine Stokes

Loomis, Sayles & Company

The Absolute Return Fixed Income Strategy seeks to achieve positive total returns over a full market cycle with relatively low volatility. The Loomis Sayles team utilizes a flexible investment approach that allocates investments across a range of investment opportunities focused primarily on credit (with interest rates and currencies as secondary investment opportunities), while employing risk management strategies designed to mitigate downside.

The investment process employs both top-down (macro themes) and bottom-up (security selection) components and uses the resources of the entire Loomis Sayles infrastructure. Drawing on the strength and depth of the entire Loomis research team, the portfolio managers identify key macro themes over multiple time horizons and assess top-down risk/return opportunities across the interest rate curve and credit markets. Fourteen Macro and Market Sector teams support the PMs by sharing their sector’s risk/ return characteristics and uncovering specific credits that they believe may offer the best return potential.

The PMs try to generate attractive risk-adjusted returns by integrating the global macro themes with the firm’s bottom-up security selection, risk analysis and trading capabilities. In selecting investments for the strategy, the Loomis team develops long-term portfolio themes driven by macro-economic indicators. These include secular global economic trends, demographic trends and labor supply, analysis of global capital flows and assessments of geopolitical factors. The team then develops shorter-term portfolio strategies based on factors including, but not limited to, economic, credit and Federal Reserve cycles, top-down sector valuations and bottom-up security valuations. Additionally, they use risk management tools in constructing the portfolio and managing risk on an ongoing basis. Common examples include single-name and index credit default swaps (CDS / CDX) to manage credit risk, Treasury futures to hedge interest rate risk, and currency futures or forward contracts to manage currency risk.

The Loomis team may invest in a broad range of positions, including, but not limited to, corporate bonds, municipal securities, U.S. and non-U.S. government securities, emerging market securities, commercial and residential MBS, CMOs, ABS, bank loans, convertible bonds, equities, and preferred securities. Long exposure is taken through both direct cash investments and derivatives, while short exposure is primarily through derivatives. The PMs may invest up to 75% of assets in below investment-grade fixed income securities (high yield bonds) and similar derivatives. Under normal market conditions, they may also invest up to 75% of assets in non-USD-denominated assets and related derivatives, including up to 50% in investments denominated in emerging market currencies. In practice, the level of non-USD exposure is typically under 10% due to investing in foreign assets denominated in USD and or/currency hedging. The strategy may also invest up to 20% of the total assets in equity-related securities. The duration boundaries of the portfolio are -5 to +10 years, although in practice the team has managed duration conservatively, typically maintaining a duration between 0 and +5 years.

Arbitrage Strategy

John Orrico, CFA

Todd Munn

Roger Foltynowicz, CAIA

Gregg Loprete

Water Island Capital

The Water Island team seeks to generate long-term returns of at least mid-single-digits with low correlation to the equity and bond markets. They do this by investing in equity and debt securities of companies that are impacted by corporate events such as mergers, acquisitions, restructurings, refinancings, spin-offs, recapitalizations, reorganizations or other special situations. Although they have the flexibility to invest in “softer catalyst” (non-merger) special situations, the Water Island team focuses most heavily on merger arbitrage. The PMs focus the portfolio on only their highest conviction risk-adjusted ideas across these strategies, invest in both U.S. and non-U.S. positions, and may employ leverage, to a limited extent.

Merger arbitrage is a specialized investment approach designed to profit from the successful completion of mergers, takeovers, tender offers, leveraged buyouts, etc. When a deal is announced, the target’s stock price typically appreciates because the acquirer typically pays a premium relative to the current market price. Until the deal closes, however, the target’s stock price generally trades at a discount to the deal price. This discount is called “the spread.” The spread typically exists because investors demand compensation for the risk that the deal may fail to close and for the time value of money for the time it takes the deal to close. The most common arbitrage approach, and the approach the Water Island team generally uses, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon completion of the acquisition. The PMs will typically be long the target’s stock and short the acquirer’s stock (to hedge the market risk and lock in the spread in situations where the acquirer is using stock and not cash to fund the acquisition). The PMs will also use options to hedge deal-specific and market risks, especially in the case of cash-only deals where the team will only be long the target’s stock. They may also gain exposure to a deal through the target company’s debt if they find that to be a better risk-adjusted return.

To answer critical questions about the deal’s probability of closing successfully, the Water Island team reviews SEC filings, listens to company conference calls where management explains the rationale behind the merger, talks to sell-side and buy-side analysts, key shareholders, and others to assess shareholder sentiment and regulatory risk. In some situations, they also talk to lawyers to get a legal opinion, especially if the deal involves regulators in multiple jurisdictions. The team builds pro-forma balance-sheet, income, and cash- slow statements, typically looking out 12 months, to see where the synergies of the combined entity may lie.

A key area of emphasis for Water Island is assessing the downside risk associated with deal failure. Either a decrease in the share price of the target or an increase in the share price of the acquirer has negative implications, so the Water Island team performs valuation analysis to assess downside from a deal break. This analysis includes looking at how the companies have traded relative to their own history and peers, whether the target had an embedded “acquisition premium” prior to the deal announcement, and the fundamental and market performance of the target’s industry following the deal announcement but prior to the deal close. At the portfolio level, the PMs and risk manager also consider the concentration of risks in the portfolio by several factors, including industry exposure, regulatory agency exposure (e.g., deals requiring Chinese regulatory approval have been a heightened risk for several years), and others (e.g., “tax inversion” deals came under heavy scrutiny several years ago). The goal is generally not to avoid a specific risk, but rather to understand and limit the aggregate exposure to it, as well as be sure the expected return compensates appropriately for the level of risk to the portfolio.

Long/Short Credit Strategy

Adam Dwinells

Stephen Kealhofer

Tim Kasta

Richard Donick

Paul Harrison

Blackstone Credit, Systematic Group (fka DCI)

The Systematic Group within Blackstone Credit (formerly known as DCI before being acquired by Blackstone in 2021 and referred to here as DCI for clarity and brevity) is a San Francisco-based, corporate-credit-focused investment firm that manages systematic, quantitative-driven portfolios of long-short, long-only and net-short credit strategies.

DCI’s investment philosophy is based on their belief in two core characteristics of the credit markets: first, that credit markets contain exploitable information gaps; and second, that credit markets are poorly diversified and inefficient. Over the course of 20-plus years, DCI’s principals have built and refined a systematic investment approach that takes advantage of these credit market inefficiencies.

DCI’s investment process is designed to exploit information gaps between credit and equity/options markets, and other market inefficiencies to identify and capture mispricing at the individual asset level. The principal driver of DCI’s strategies is its dynamic, proprietary default probability model, which incorporates fundamental balance sheet information and real-time information embedded in equity and options markets. DCI’s model uses this information to calculate “fair value” credit spreads that, when compared to market spreads, identify mispricings that can potentially be exploited. Excess returns are anticipated over time as market spreads converge toward the model’s assessment of fair value.

The Long-Short Credit Strategy consists of two components: a market-neutral, long-short single-name CDS sleeve; and a high yield bond portfolio hedged primarily with Treasury futures and CDX to minimize interest rate duration and credit market beta. The intent is to generate returns from idiosyncratic credit selection rather than the movement of credit markets or interest rates. As such, correlations to systematic market risks including high yield and equity market returns are intended to be, and have been, very low, and strategy returns are largely uncorrelated to those of other active credit strategies. The Long-Short Credit Strategy is designed to perform in both low and high volatility environments although returns are expected to be higher in higher spread, higher volatility environments.

DCI believes that the inability of conventional credit approaches to consider equity and other market information systematically, and their propensity to build portfolios around issue weightings, are features that create persistent inefficiencies in the market. These features are largely driven by the qualitative, discretionary style that conventional credit market participants use. While marginal information efficiencies are likely to come about as a natural part of the credit market’s maturation, as long as conventional credit investors dominate the market, exploitable inefficiencies will exist for DCI. The firm believes its approach of integrating technology, infrastructure, ongoing research, and credit expertise is unique in the industry. The resources of Blackstone as a parent organization should only enhance the team’s capabilities going forward.

Enhanced Trend Strategy

Andrew Beer

Mathias Mamou-Mani

Dynamic Beta Investments[1]

Dynamic Beta Investments (DBi) is a New York-based, alternative investment manager with expertise across several hedge fund replication strategies. The firm was founded in July 2012 and manages over $1 billion across several hedge fund replication strategies, including Managed Futures, Multi-Strategy and Equity Long/Short.

The Enhanced Trend strategy seeks to achieve attractive absolute returns over multi-year periods, with low correlation to equities and fixed income and the potential to generate positive performance during periods of sustained declines in equity markets. The strategy is a replication blend of 75% trend-following (TF) and 25% equity hedge (EH).

DBi believes hedge funds can add value to traditional portfolios on a pre-fee basis, but that ability is due largely to their flexibility to make sector, geographic, and/or style shifts. Although these are generally expressed through individual security selection (except in managed futures/trend-following funds), the majority of returns can be explained by the shifts in beta exposures over time.

Through a relatively simple returns-based model and liquid futures contracts on less than 20 assets/markets, DBi can very accurately replicate the beta exposures of a pool of hedge funds, and thus the great majority of the returns. Minimizing the fee and expense drag (“fee disintermediation”) allows the DBi strategies to deliver net returns to investors that are highly correlated to, but better than, the net returns of the target hedge fund groups.

DBi first creates the Target universe (the group of hedge funds whose returns will be replicated). For EH hedge, this consists of 40 of the largest long-short equity hedge funds (limited to one fund per firm to increase diversification). For TF, this consists of a group of the largest trend-following funds, a subset of the broader CTA universe. DBi’s model is a multi-factor regression that uses the Target’s trailing returns to determine the set of beta factors (e.g. MSCI EAFE, gold, JPY/USD, 2Yr US Treasury) that would have most closely matched those returns. With some relatively minor constraints, the model constructs the portfolio using highly liquid futures contracts across equity indices, currencies, rates, and commodities to replicate these exposures. For EH, the model rebalances monthly. Underlying hedge fund performance is typically reported monthly and the positioning tends to shift relatively gradually. For TF, the model rebalances weekly. Performance of many TF managers is typically reported daily and the exposures of the underlying funds tends to change more quickly than EH managers (depending on the prevailing trends in markets).

Risk management is largely a function of replicating diversified portfolios with highly liquid instruments, but the process also incorporates a “post-processing” adjustment that can reduce exposures pro-rata if the volatility jumps because of market changes shortly after the portfolio is rebalanced. This isn’t uncommon but is typically fairly minor. Counterparty and credit risk is minimal since DBi trades in exchange-traded instruments only, which bear no counterparty risk.

Performance Analysis:

Performance quoted is for the Institutional share class, represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Other share classes may impose other fees. To obtain standardized performance of the funds, and performance as of the most recently completed calendar month, please visit https://imgpfunds.com.

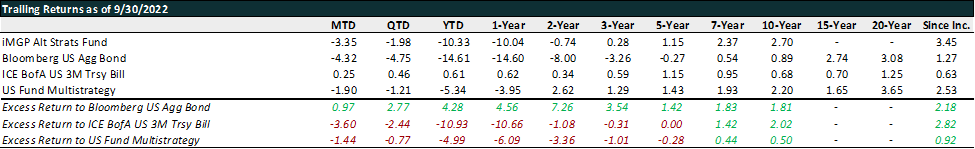

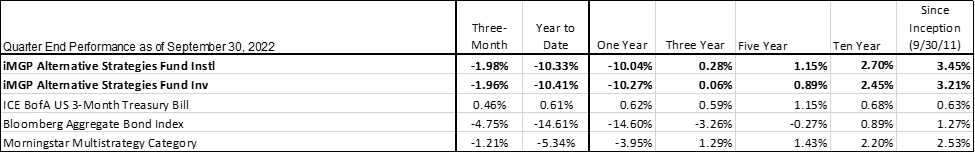

The fund has struggled recently, with a -10.33%% YTD return through September, compared to a staggering (for core bonds) -14.61% loss for the Bloomberg Aggregate Bond Index (the Agg). Although this is not the fund’s official benchmark (3-month Treasury Bill is the benchmark), we use the Agg as a comparison since many investors view the fund as a complement/diversifier to their core bond allocations, typically funding most of their investment in the fund from core bonds. The fund’s performance is understandable given the context of what has been an extremely challenging environment across almost all markets this year, but it is disappointing, nonetheless.

The fund’s recent performance has been impacted by the simultaneous steep losses across almost the entire spectrum of asset classes, from equities to credit (both straight corporate as well as asset-backed) to government guaranteed MBS, with little regard to the underlying fundamentals. The fund’s ability to protect capital has suffered on a relative basis compared to its own history in part due to this phenomenon. The fund’s arbitrage and low net/market-neutral strategies have been strong relative performers, but not enough to maintain the fund’s historical ~0.2 or lower downside beta to equity markets.

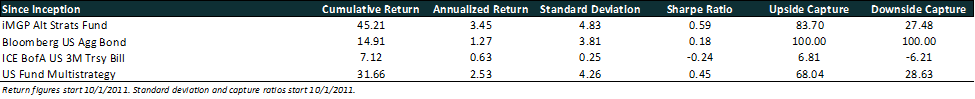

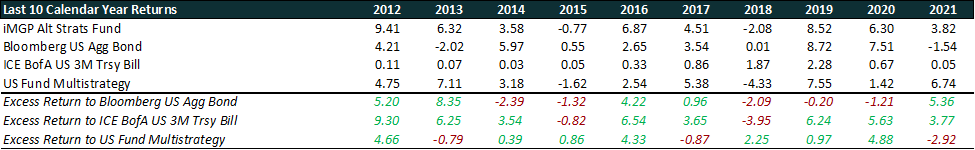

The sensitivity of trailing returns to this endpoint has dented the fund’s medium term track record, leading to annualized returns of just 0.28% and 1.15% annualized for the trailing three and five years, respectively. While still significantly outperforming the Agg’s -3.26% and -0.27% annualized returns over the same time periods, the fund’s returns are clearly below long-term expectations. Extending the track record to 10 years and since inception, the fund’s performance increases to annualized gains of 2.70% and 3.45%, respectively. Again, this is significantly ahead of the Agg’s 0.89% and 1.27% annualized gains over the same trailing periods.

This performance differential has been achieved with volatility running somewhat higher than the Agg, though well within the range of long-term expectations of 4-8%. (Until the COVID-19 pandemic, the fund’s annualized standard deviation was below 4%.) Since inception, the fund’s standard deviation is 4.83% annualized, compared to 3.81% for the Agg. More recent differentials have been somewhat wider, with the fund showing approximately 2.3 and 1.5 percentage points higher standard deviation than the Agg over the trailing three and five years, respectively. The fund has fared well in terms of capital preservation relative to what most consider the “safe haven” of core bonds. Perhaps surprisingly, using monthly returns, the Agg now has a larger drawdown (-16.1%) than the fund (-10.73%), as well as a more negative worst-12-month-return (-14.60% for the Agg, compared to -10.04% for the fund).

Although the current drawdown is unpleasant and mildly unusual in its relation to traditional asset class performance, ultimately, we are confident in our belief that the fund performance can bounce back strongly, echoing the performance pattern we have seen historically. This belief is supported by the attractive yields relative to duration we observe in the fixed income-oriented managers’ portfolios; the high annualized deal spreads in the merger portfolio; and the above average overall credit spreads and differentiation in fundamental default probabilities for the long-short credit portfolio. These characteristics have typically preceded periods of very good performance for the fund. They also have not typically persisted for extended periods as capital returned to close spreads to more “normal” levels as fear and uncertainty receded. Even while measuring at a relative low point in performance, the fund has still produced returns within the range of expectations since inception. With what appears to be a portfolio poised to generate attractive returns on a forward-looking basis, we believe full-cycle, medium-term performance will revert to levels consistent with our expectations while still soundly outperforming core bonds.

Opinion:

We believe the Alternative Strategies fund is a strong option for core, multi-strategy alternatives exposure. The fund has largely achieved its goals over most of its life, although recent performance has been below expectations, for understandable reasons. We do not expect the fund to be an explicit hedge for equity or interest rate risk but to reduce volatility during challenging market periods due to the subadvisors’ active risk management, as well as the inclusion of strategies that have more diverse and somewhat independent drivers of return. This allows the subadvisors to be more aggressive in raising their level of exposure when opportunity sets are more compelling. The willingness to accept some shorter-term volatility in exchange for higher medium- to long-term returns is a conscious choice, although we have increasingly focused research efforts in recent years on the potential addition of strategies offering even greater diversification (such as DBi) without detracting from expected returns. In a reflection of our confidence in the fund, it is used broadly in client accounts at our affiliated RIA (with management fees credited back to clients to avoid “double-dipping”) and widely held across the firm’s employee base, with very significant personal investment by the iMGP portfolio managers. We believe this offers strong alignment of interest with the fund’s outside shareholders.

Note: For discretionary use by investment professionals. This document is provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Past performance may not be indicative of future results and there can be no assurance the views and opinions expressed herein will come to pass. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

The [investor] acknowledges that AdvisorIntelligence is beneficially owned by iM Square SAS, a Paris based investment and development platform (“iM Square”). AdvisorIntelligence, from time to time, expects to include in its investment models certain investment funds (collectively, “iM Square Funds”) sponsored or managed by investment advisers in which iM Square has a beneficial ownership interest (“IMGPUS Affiliates”). This arrangement creates a material conflict of interest because AdvisorIntelligence has an incentive to include iM Square Funds in its investment models. IMGPUS Affiliates do not waive fees for these investments. Therefore, assets invested in iM Square Funds will be charged two layers of fees, one by AdvisorIntelligence and another by the iM Square Funds.

Our due diligence process for managers and funds is grounded in our conviction, supported by extensive research, that skilled managers can and do deliver superior performance over the long term. An essential part of the value we provide is the multiple decades of experience we bring to bear in assessing and selecting exceptionally skilled managers. We engage in exhaustive quantitative and qualitative research aimed at uncovering those select managers with an identifiable and sustainable investing edge. Here are just a few critical elements we look for in our due diligence:

- A clearly defined and well-articulated investment process supported by evidence of successful implementation over time

- A manager or team that demonstrates a high level of integrity, intellectual honesty, and a passion for investing

- Supportive team dynamics and a culture that insulates key investment personnel from noninvestment-related responsibilities

- Outperformance versus relevant benchmarks and peers that is consistent with our expectations given certain market environments

- Consistent outperformance (i.e., over rolling periods) versus benchmarks and peers that is a result of a time-tested investment process

This rigorous process yields a select list of managers. For those we decide to invest with, our analysis is not a once-and-done exercise. We continue to closely monitor fund performance and investment decisions through regular updates with our managers, aimed at making sure they remain committed to their investment process and disciplined in its execution and is the basis for the opinions shown below.

Recommended = These are funds we are confident will outperform an index fund alternative over a market cycle.

Approved+ = Approved funds we are actively researching and consider to be realistic candidates for upgrading to Recommended.

Approved = Funds we believe will perform at least as well as, if not in excess of, an index fund alternative over a market cycle.

Noteworthy = Funds we view as promising. The record may be too short or we may need to do additional due diligence before making a final decision on the status (Approved, Recommended) of the fund.

Under Review = We are currently conducting follow-up due diligence to address questions that have arisen since our last review. While these questions are material enough to warrant further investigation, we do not feel they are material enough to warrant an immediate downgrade.

Recommendation - Index Funds & ETFs

Core = Funds/ETFs that are our preferred vehicle for gaining index exposure to an asset class. These vehicles are recommended for those who would rather use an index fund in lieu of funds in the model portfolios.

Tactical = ETFs and index funds we are currently using or have used in the past for tactical purposes in place of Core funds.

Alternative = Funds we believe are acceptable alternatives to Core funds, though they are not our preferred choice due to any number of factors, including expenses, asset base, index construction and methodology, and the experience of the fund sponsor.