iMGP Portfolio Strategies

Overview

About

The iMGP Portfolio Strategies offer financial advisors access to globally diversified, risk-managed tactical portfolios that are based on iM Global Partner’s rigorous, independent research and disciplined investment process. We have designed a range of model portfolios and implementation options that allow advisors to align the appropriate portfolio with their client’s investment goals, risk tolerance, and investment preferences—all in a simple turnkey solution.

Investment Approach

The iMGP Portfolio Strategies are designed to be a core holding in a client portfolio. We'll always have exposure to the markets similar to the portfolios starting allocation and will seek to use our tactical flexibility and manager selection to improve returns and manage risk.

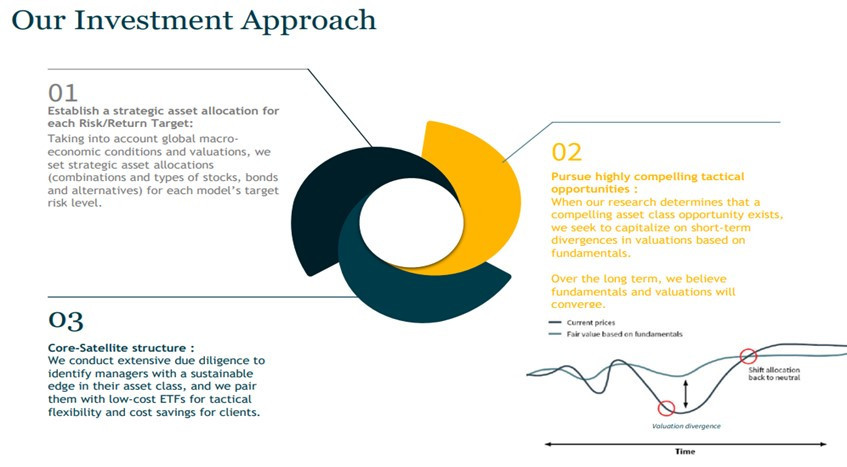

The starting point for our investment process is a long-term strategic allocation we believe offers the best return potential for a given level of risk. The strategic allocations are an important part of our process for several reasons: 1) they serve as a starting point for advisors to discuss risk and return expectations with clients. 2) they provide a framework against which we can judge our tactical allocation decisions and manager selection. 3) finally, they represent the most optimal allocation in the absence of any near-term tactical opportunities.

From there we'll look to make tactical shifts away from the strategic allocation when our research identifies compelling opportunities at the asset class level to either improve returns or manage risk. As investors, we believe that financial markets are efficient - most assets are fairly valued most of the time, meaning it's difficult to outsmart or beat the market. However, the market does, occasionally, offer investors exceptional opportunities and capturing a portion of these opportunities and locking them in over a full market cycle is how we seek to generate outperformance.

Finally, we further seek to add value by selecting high-quality, active managers we believe can deliver outperformance over time. Our manager due-diligence process is focused on identifying managers that have some sort of long-term competitive edge. That edge may come from the managers access to information, their investment process, or their opportunity set - whatever it is, that is what we're seeking to identify and articulate.

Our Strategies

The iMGP Portfolio Strategies are managed the same from an asset allocation and risk management perspective. The difference lies in the implementation. Despite our success over the long-term with an active approach, we also understand the benefits of index investing for certain clients. For this reason, we provide active, index-based, and core-satellite portfolio strategy options. In addition, we also offer a set of model portfolios with an ESG mandate.

Alpha-Core

The Alpha-Core portfolios combine active strategies seeking alpha with passive strategies intended to reduce costs and taxes. The portfolios feature a mix of iMGP funds alongside third-party funds and ETFs. The Alpha-Core portfolios are an appropriate solution for investors seeking the potential to generate outperformance at an attractive total cost to clients.

Active

The active portfolios consist of a core allocation to third-party, actively managed fixed-income, equity, and alternative strategies mutual funds. Our due diligence process for managers and funds is grounded in our conviction that skilled managers can and do deliver superior performance over time. The active portfolios are an appropriate solution for investors who believe that it is possible to identify highly skilled managers who can outperform the market.

Index-Based

The Index-Based portfolios feature a strategic and tactical asset allocation implemented largely with low-cost, passive ETFs. The ETF portfolios are an ideal solution for investors seeking lower tracking error, cost, and taxes.

ESG

The ESG model portfolios are managed using the same asset allocation and risk management framework as our traditional portfolios. However, the ESG portfolios are implemented with funds and ETFs that have an explicit ESG or sustainable investing mandate. The ESG portfolios are an active/passive solution that help clients reach their long-term investment objectives, while also reflecting their personal values.